The European Court of Auditors released a very interesting report on the state of public procurement in the EU. It took data for a 10 year period from 2011 to 2021 and analysed the data. This is an intelligent and clever approach to auditing this area. New directives were passed in 2014 by the Commission but only came into effect from 2015 (on a staggered basis in each country) so it provides roughly equal amounts of time prior to and since the adoption of the new directives.

The results from the report are quite damning for the EU and the report authors call for a rethink on the Directives. We step through some of the key findings below.

Decline in competition

The European Court of Auditors found that the level of competition for public contracts decreased over the past 10 years in the EU and that there is a lack of awareness of the importance of competition in procurement. An absence of competition makes it difficult to drive value for money. Furthermore, neither the Commission nor Member States made systematic use of data to identify the root causes of limited competition in public procurement. The only actions taken were scattered, somewhat random and lacking in coordination to reduce obstacles.

In 2021, the following three indicators to measure competition in public procurement remained unsatisfactory in most member states.

- No calls for bids – it was not put out to tender

- Single bidder – only one response was received

- Numbers of bidders – overall lack of competition

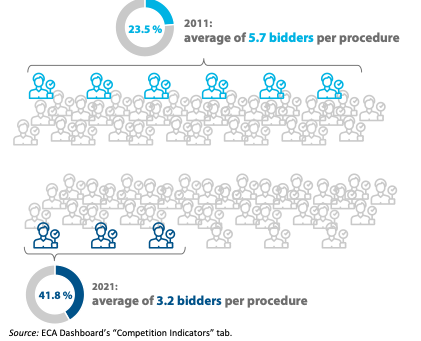

The decline in competition over the past ten years has been stark. From an average of 5.7 bidders per procedure to 3.2.

One factor behind this (our speculation rather than the report) may the abolition of the requirement to seek at least 3 bids for goods and services under the old 2004 regime. A single bid can be accepted now whereas this was not an option under the old regime. In this context, it is unclear how much ‘real competition existed and how much real competition has, in reality, been eroded. Be that as it may, the intention of the reformed directives was to increase competition and on the raw numbers, this is an empirical, a priori, failure.

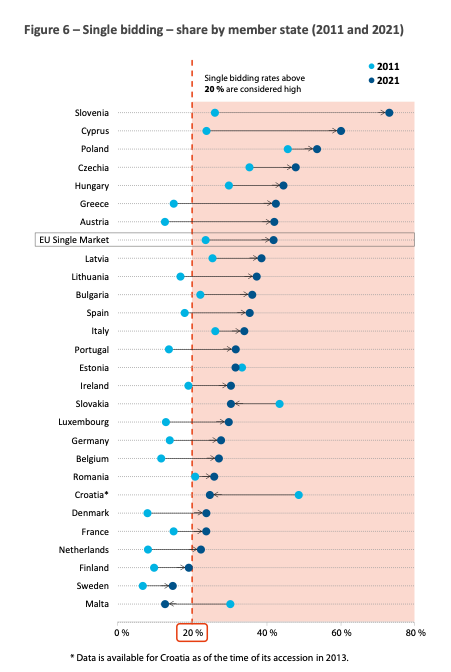

Across the EU direct awards (i.e. no tender process took place) accounted for around 16 % of all public procurement procedures. Further to this, over 40% of all awards were made under procedures in which there was only one bidder. The data analysis showed that single bidding across the EU-27 member states nearly doubled between 2011 and 2021, and that the number of bidders per procedure almost halved. Only Malta, Slovakia and Croatia saw significant drops in this number.

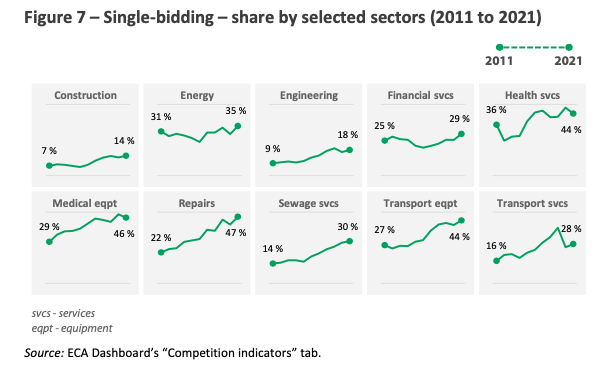

Significant differences from one member state to another and from one region to another indicate that member states’ contracting authorities take diverse approaches to their procurement practices. There were big differences between regions in terms of the prevalence of these practices. The Peloponnese in Greece had the highest rate in Greece and the EU (67%) of single bidding whereas places like Łódź in Poland are among the lowest anywhere. Also, contrary to what one might expect, the much maligned construction sector rose quite slowly in terms of single bidding relative to other sectors.

Cross border procurement

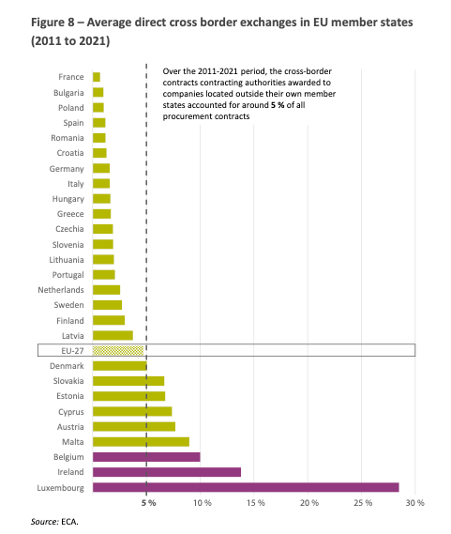

The European Court of Auditors also analysed other aspects of public procurement performance in the EU single market, such as direct cross border procurements. Cross border contracting has remained stubbornly low over the years at around 5% of all contracts. This contributes to the absence of competition. As the Commission does not monitor data on prices, it is unclear to which extent the trend of decreasing competition has already had an impact on cost of public works, goods and services but there are few, if any, parts of the EU where governments are not experiencing inflationary effects. As any economist will tell you, the solution to high prices is abundance. Absence of competition means prices being charged are not being subjected to the beneficial downward pricing pressure of competitive forces.

Impact on SMEs

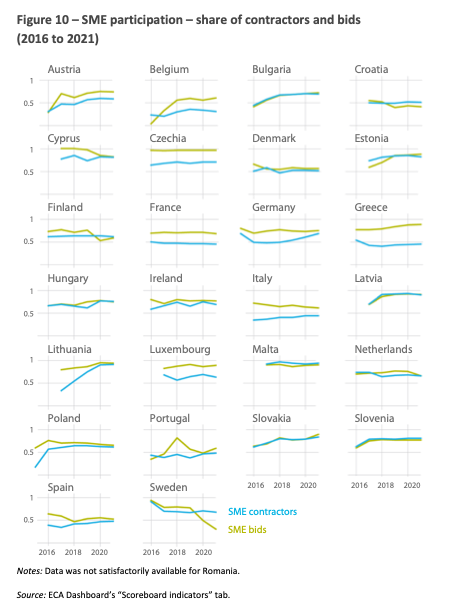

The 2014 reform of the procurement directives was meant to make public procurement simpler and more flexible, increase the transparency of procedures, guarantee easier access for SMEs, and make strategic use of public procurement to support EU policy objectives. In the case of improving participation by SMEs, to pick one of these aims, the European Court of Auditors found no clear evidence of success in this regard. The diagram below focuses specifically on the post-2014 implementation period of the new rules.

The data analysis showed that the 2014 reform has not led to any significant improvements in procurement outcomes. Not only this,

- Simplification has not happened and there was no significant improvement that has made public contracts more attractive to contractors.

- Moreover, the average duration of public procurement procedures has increased by half since 2011 meaning contractors (and under bidders) are waiting longer to hear whether they have been successful.

Initiatives such as the European Single Procurement Document and eForms demonstrated the Commission’s intention to simplify public procurement procedures and reduce the associated administrative burden, but their impact has still to be demonstrated.

We summarise their aim as follows:

- ESPD – the aim was to streamline and reduce the frequency with which suppliers have to repeatedly submit the same information (it was to act like a supplier passport on mandatory, standard requirements). In countries like Ireland, as practitioners, we would point out that it is very common for ESPDs and tenderer declarations covering the exact same questions as the ESPD to be sought in three separate ways on every single EU level tender. So if this is meant to simplify things, it isn’t penetrating locally in some markets.

- E-Forms – the aim is to improve data in TED (the EU tendering database) but the implementation is problematic and it is uncertain as to whether this can be easily achieved across all the different tendering engines in the EU. Even if the data is there, it is unclear as to whether it will be leveraged to enhance competition and make it easier for contractors to participate etc. At the moment, it looks like bureaucracy for the sake of bureaucracy. It may help administrators, but will it help create more competition? This remains to be seen.

Finally, the European Court of Auditors noted that other objectives are also unsatisfactory in terms of progress. For instance, environmental, social or innovative aspects are rarely used and/or have had very limited impact on the overall share of procedures and the market as a whole. It remains the case that start-ups cannot easily consider let alone get through tender processes. Other economic blocks are doing a much better job bringing emerging technology and creative solutions through their tender processes. Anybody interested can check some of the innovative case studies on Citymart or the stories covered by Bloomberg’s Citylab sub-site.

As is often the case in a market like the EU where regulation dominates dynamism, the effect seems to have dampened competition and fallen short of its own stated objectives.