Pricing strategy: Using game theory to win

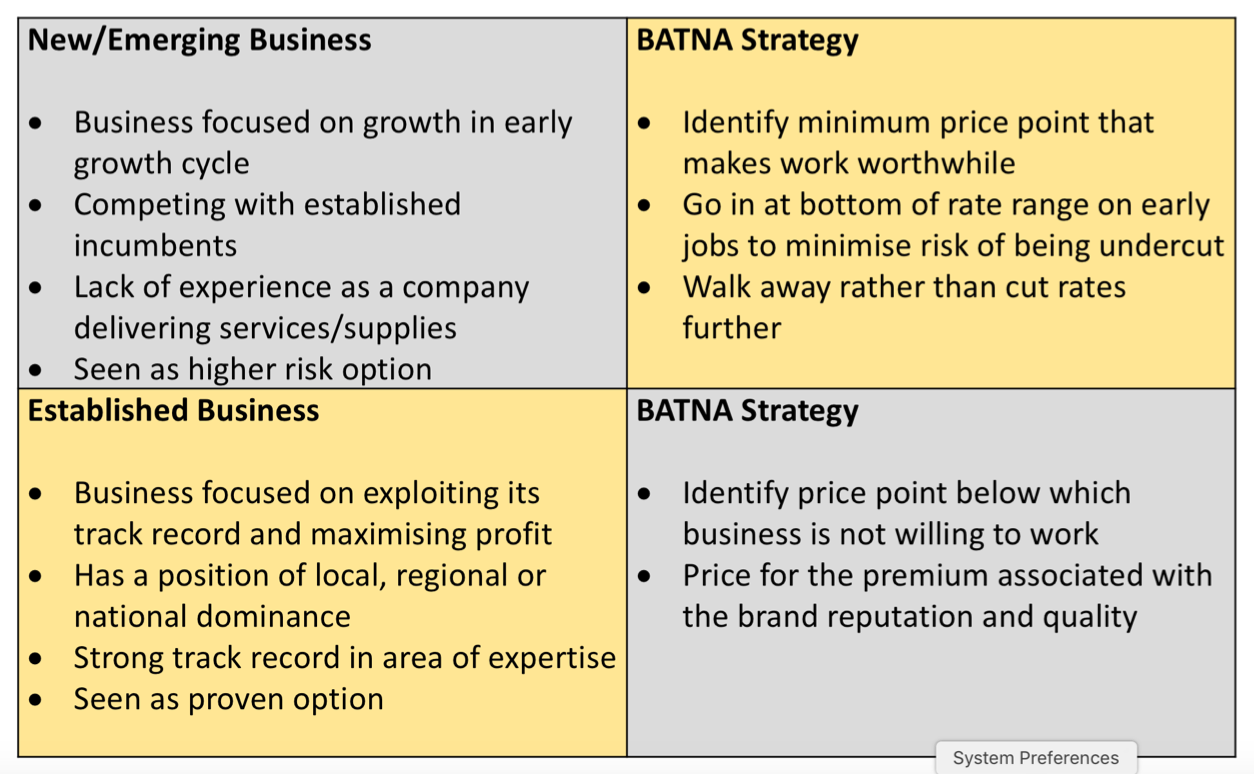

We are often asked by companies whether there are new or different approaches they can take towards their pricing strategy. When this arises, we explore the extent to which they are aware of and consciously use game theory in their business. Most businesses do this to a point without ever calling it game theory (a background article on this can be found here). There are often applications for game theory in the winning of work with customers. We have looked at a number of different strategies for price dominated market contests and believe that the application of game theory really falls into two categories depending on whether the business is new or established.

Ultimately, both scenarios, are defined by understanding one’s own BATNA point. BATNA stands for the Best Alternative To No Agreement. While there are many scenarios that BATNA can apply in, here, we are interested in exploring its application to pricing strategy.

For each of the business types described above, the pricing strategy is charted out. In both cases, the objective is to increase supplier power (or control) over the outcomes even if the Buyer continues to set the market conditions.

The emerging business wants to stay busy and build their experience levels. They do this by maximising the work they are capable of bringing in while covering their target costs and profits. As experience builds, they start to revisit their commercial strategy and charge accordingly.

An established business will seek to win work from long-term relationships. As a result of these relationships, increased financial solvency, and their track record, they can price to reflect their brand profile and brand equity. Established businesses maximise their wins by applying stringent criteria before they bid/quote for work. The objective should be to bid as little as often by being the buyer’s preferred supplier.

Buyers will often play with suppliers to maximise the benefit to them. Established businesses need to think through whether or not the opportunity in question is one that requires their experience and track record. If it does, then they may be willing to play hardball on price. If it doesn’t, the buyer will often make this point to the established business with a view to driving their preferred option closer to the new/emerging business rates. They may only actually go with a new / emerging business where no accommodation can be made and the established company is unwilling to compromise.

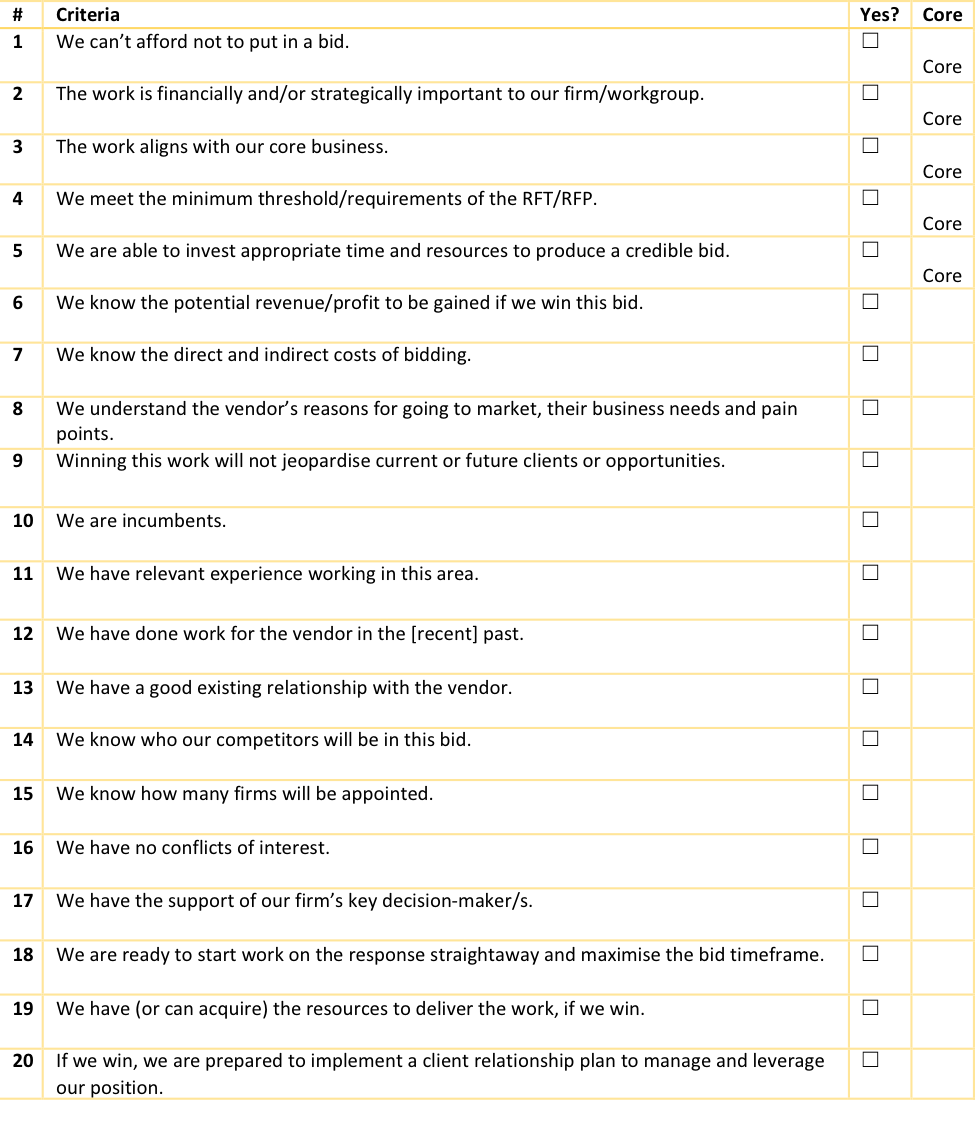

Protracted negotiations can be avoided in many cases by adopting the right stratagems for commercial opportunities. Companies can further improve their chances of winning deals by using go / no-go criteria that determine when a company is going to submit a quote / tender.

Companies should only consider bidding when they exceed twelve of the twenty criteria and at least three of the five core criteria.